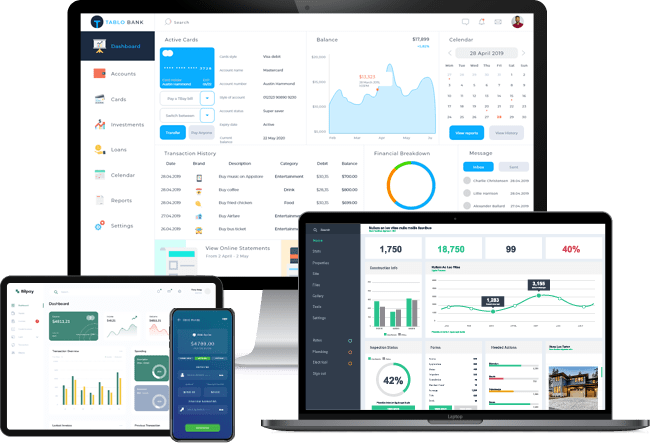

MIS Technology CBS

The full functions core banking system for financial institutions of all sizes.

Our flagship product is a comprehensive Core Banking System specifically designed to address the operational challenges and growth ambitions of Rural Credit Operators, Microfinance Institutions, and Small to Medium-sized Banks.

Customer Management

Keep track of all interactions with your customers and allow your agents to instantly access historical activity.

Loan Management

Keep track of all interactions with your customers and allow your agents to instantly access historical activity.

Accounting Management

The process of recording, organizing, and analyzing a company’s financial activities to support decision-making and ensure accuracy.

Cash Management

The process of handling a company’s cash flow to ensure there is enough money to meet daily expenses and obligations.

Fixed Asset Management

The process of tracking and maintaining a company’s long-term assets like buildings, equipment, and vehicles to ensure proper use and accurate financial reporting.

Risk Management

The process of identifying, assessing, and minimizing potential losses or threats that could affect a business.

Advanced Package

Saving Module

Support fixed period and non-period Saving Account Passbook types.

Fixed Deposit Module

User definable Fixed Deposit Types, support Fixed Deposit Auto Rollover, Auto Interest Accrued and Withholding tax on interest applies.

Current Account Module

Support Individual and Company accounts, support Cheque issuing and maintenance, support Cheque Encashment.

Foreign Exchange Module

User definable Currency exchange rates against base currency for both buying and selling.

Cash in Vault Module

Maintaining Cash in vault operation, issuing cash to Teller and return back to cash in vault using Online message by system.

Remittance Module

Support CITAD format Import / Export, support payment by Cash, Customer Account, Nostro and Connection Account.

Report Module

Provides powerful tools for generating real-time and scheduled reports across all banking operations. Designed for accuracy, compliance, and decision-making, it enables users to access detailed insights on loans, accounts, transactions, customer activity, risk, and financial statements.

Financial Report Closing

Daily Closing operation with various options, Auto GL postings for Interest Accrued on Daily close, Auto rollovers on Daily closing, Auto Cash in vault balance checking on daily closing, Auto Interest Calculation on Monthly closing, Auto Foreign Exchange Income Reconciliation posting on Monthly closing. Auto Income Expense Foreign currency Transfer to Base currency on Monthly closing, Auto transfer of Income Expense to Profit and on Yearly closing.

Borrowing Management

Business Day definition setup, Signature Captured and stored in Database, Online Transaction Enquiry, Old Transaction slip Reprint, Interest Projection Details, User Online Status verification, Easy toll tip Reference and Reversal and Auto Rollback facility.

Corporate Banking

Is a service provided by banks to businesses and large organizations, offering financial products like loans, cash management, and trade finance.

Business App

Whatever your business, a mobile app will provide you with a number of benefits! To get an idea of what you can expect to see from your mobile.

About

Customers

Press

Support

Products

MIS Technology CBS

MIS Technology LOS

Contact Address

+855 116 220 223

info@mis.technology

Cambodia Office

#HONEY-C01, E09A(1st floor), Str.371 Phum Obek Kaom, SangKat Obek Kaom, Khan Sen Sok, Phnom Penh Cambodia.